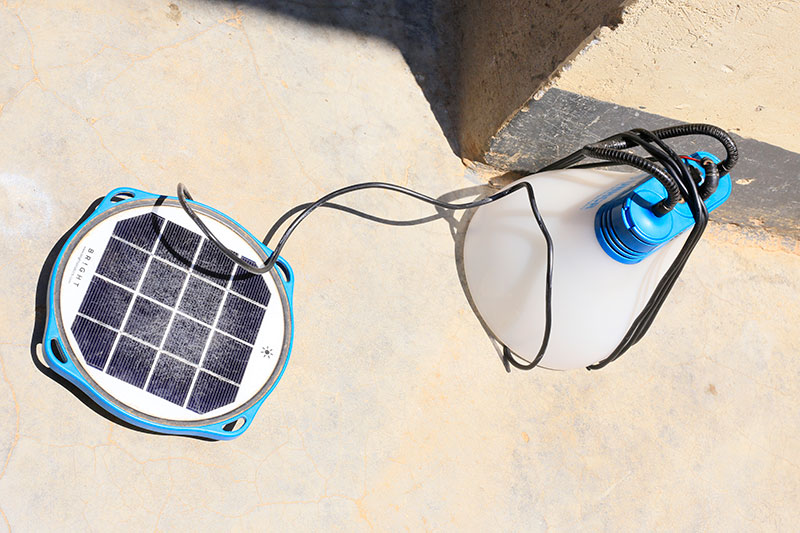

Working in partnership with regulated Financial Institutions and Tier IV Financial Institutions, UECCC has put in place a facility that enables households and commercial enterprises acquire solar systems on credit.

There are two loan categories under this program;